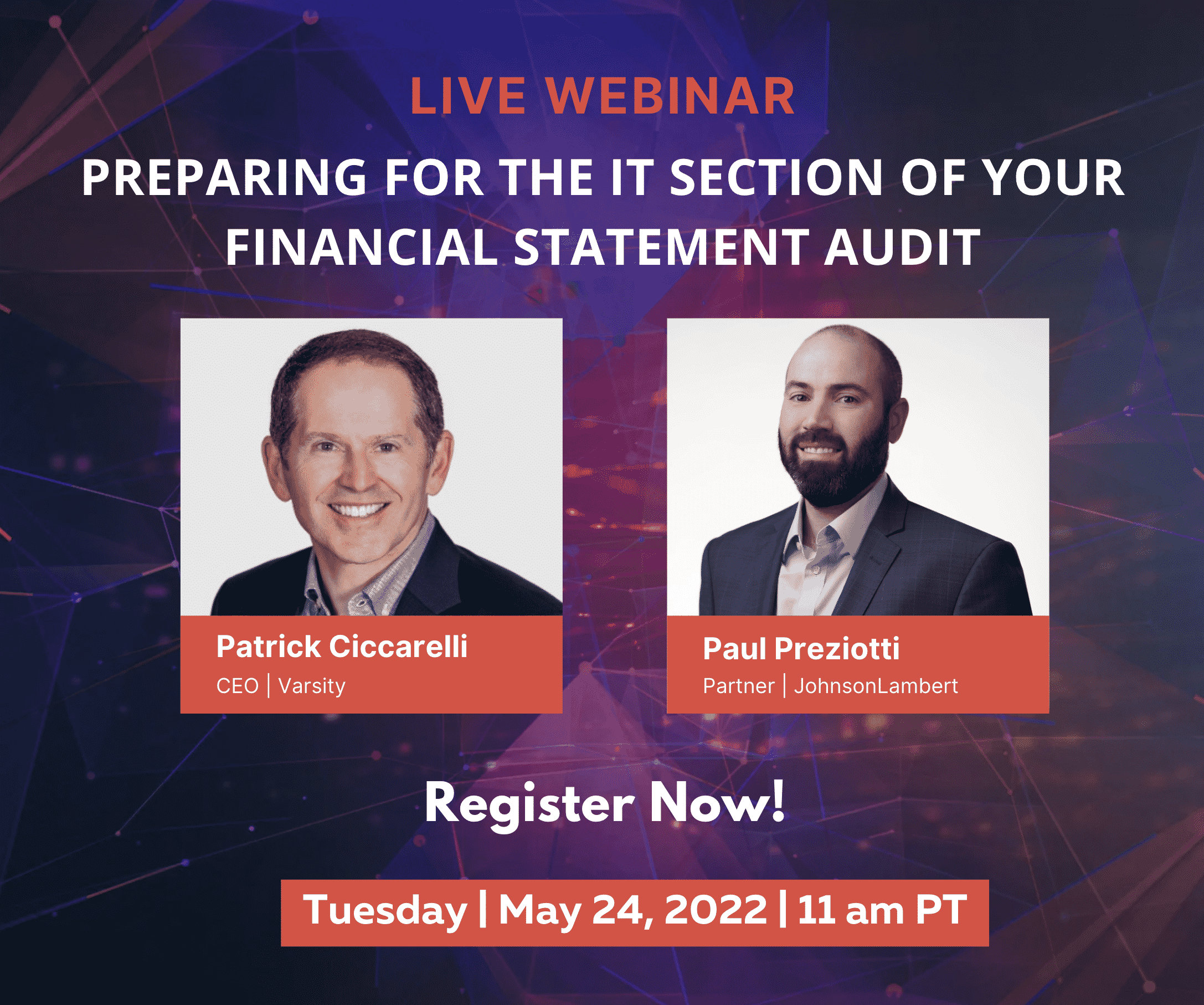

Mark your calendars for this upcoming Varsity webinar on May 24th at 11:00am PT all about the IT section of your financial statement audit. The webinar be hosted by our CEO and Founder, Patrick Ciccarelli and Paul Preziotti, CPA at Johnson Lambert LLP. They will dive into common questions to expect during an IT audit process and how to plan accordingly. You can register here and continue reading to learn a bit more about this topic before the webinar.

What is a Financial Audit?

For nonprofit organizations, you are hopefully aware that you don’t need to pay taxes on the revenue you receive. You may even remember filling out the forms and papers when you first started your organization! While you may be exempt from taxes, it’s still important to conduct a nonprofit audit. Depending on your size, your spending, or which state you reside in, audits may (or may not) be required.

Audits occur when an auditor or auditing firm reviews your financial statements, records, transactions, accounting practices, and internal controls. The Council of Nonprofits provides an excellent guide to audits here that dives into the specifics of auditing for nonprofits. It will be a great resource to review for any specific questions. We will provide a basic overview here and dive into more specifics about the IT side of things during our upcoming webinar.

Why Are Audits Important?

According to The Alliance for Nonprofit Management, nonprofit audits are conducted “for testing accuracy for testing the accuracy and completeness of [the] information presented in an organization’s financial statements. This testing process enables an independent certified public accountant (CPA) to issue what is referred to as an opinion on how fairly the agency’s financial statements represent its financial position and whether they comply with generally accepted accounting principles (GAAP).”

There are several benefits that auditing can bring your organization, such as increased transparency and accountability, as well as finding opportunities for improvement. The Jitasa Group, an accounting firm exclusive to nonprofits, notes that they are “charity watchdogs who may rank your organization higher if you’ve conducted an audit. This also increases the element of transparency with your supporters who do their research before contributing, assuring them that you’re a trustworthy organization.”

Tips for Financial Audits

The auditing process is complex, which is why we look forward to discussing more about it during our next webinar. We wanted to provide a few helpful tips as you begin thinking about your next audit:

- Give yourself plenty of time. The auditing process takes time, as does preparing for it. The Jitasa Group recommends allowing 4-12 weeks to select your auditor, 2-4 weeks to prepare for your audit, and 2-4 weeks to conduct your audit.

- Research your auditing firm. Like any business partner, it’s important to select an auditor that will best suit your needs. Ensure you will get the most out of the auditing process by diligently researching, asking questions, and ensuring your auditor is a good “fit.”

- Consult your Provided By Client (PBC) list. This list will be provided by your auditor and will detail all the information and supporting documents needed to complete your audit engagement. It may include policies and procedures, schedules, debt agreements, and reports.

Join Varsity to Learn More

As a thought leader in IT, Varsity strives to empower the nonprofits we work with to be successful, which means making sure they are prepared for all aspects of their business — including the auditing process. We hope you can join us for our next webinar on May 24th at 11:00am PT to learn more about the IT section of your financial statement audit. See you there!